„Dimitrie Cupovski“ 13, 1000 Skopje +38923244000 ic@mchamber.mk

„Dimitrie Cupovski“ 13, 1000 Skopje +38923244000 ic@mchamber.mk

|

Association of Financial Organizations

|

|

Banks (12/12) and savings houses (2/2)

|

|

Insurance Group

- 8/11 Non-life insurance companies - 4/5 Life insurance companies |

|

Group of Non-Bank Financial Companies (22/26) |

|

Leasing Group (5/7)

|

|

Association of Insurance-Brokerage Companies (3/5) |

|

Pension companies (4/4)

|

The initiative to establish the Association of Financial Organizations was driven by the increased interconnectedness and complementarity within the domestic financial system, as well as by the accelerated development of non-bank financial companies, resulting from the provision of increasingly complex services tailored to the needs of citizens and the private sector.

On 27 June 2019, the first founding and constitutive assembly of the Association was held, at which a Management Board composed of representatives from various types of financial institutions was elected, and the Work Program through which the planned activities will be carried out was adopted.

The Association of Financial Organizations is the only form of association in the country that unites all participants in the financial sector – banks, savings houses, insurance companies, pension fund management companies, non-bank financial institutions, and leasing companies – fostering joint engagement and long-term cooperation by facilitating inter-sectoral forms of partnership.

One of the key objectives of the Association is the joint identification of the challenges faced by the entire financial sector, with the aim of finding comprehensive solutions that will create better operating conditions for the member companies in this sector. In parallel, the Association will strive to introduce new programs and projects aimed at strengthening and advancing the financial system, as well as at fostering closer cooperation with all relevant stakeholders. Through the activities of the Association, we believe that we can significantly contribute to improving the regulatory framework and more effectively articulating the interests and needs of the financial sector.

The financial sector plays a central role in the country’s economic development: it promotes savings and investment, creates linkages among all actors, and facilitates the expansion and modernization of financial markets.

Membership in the Association of Financial Organizations includes:

- All commercial banks (12)

- All savings houses (2)

- 8 out of 11 non-life insurance companies

- 4 out of 5 life insurance companies

- 22 out of 26 non-bank financial companies

- 5 out of 7 leasing companies

- All pension companies (4)

- 35 insurance-brokerage companies

At the session held on 23 January 2025, the current composition of the Management Board of the Association of Financial Organizations was elected, with a four-year term. The President of the Association is Blagoja Ustijanovski, Director of the Corporate Clients Division at Sparkasse Banka AD Skopje, and the Vice President is Aleksandar Todorov, Branch Manager for Medium-Sized Enterprise Lending at ProCredit Banka AD Skopje.

⮞ Blagoja Ustijanovski, President, Sparkasse Banka AD Skopje, Skopje

⮞ Aleksandar Todorov, Vice President, ProCredit Banka AD Skopje, Skopje

⮞ Ralica Guberova, MBA, Euroins Insurance, Skopje, and President of the Insurance Group

⮞ Aleksandra Shkembi, Uniqa Life, Skopje, and Vice President of the Insurance Group

⮞ Nikola Joshevski, Mint Group, Bitola, and President of the Group of Non-Bank Financial Companies

⮞ Biljana Mishikj, Iute Group and Vice President of the Group of Non-Bank Financial Companies

⮞ Olivera Klincharova, Delta Ins Brokerage Company and President of the Association of Insurance-Brokerage Companies

⮞ Marjan Manchev, Sparkasse Leasing DOO Skopje, Skopje, and President of the Leasing Group

⮞ Vesna Stojanovska, KB First Pension Company,, Skopje

⮞ Eleonora Zgonjanin-Petrovikj, Manager of Fulm Savings House

⮞ Filomena Pljakovska-Asprovska, International Card System – KASIS Skopje, Skopje

The financial system plays a key role in the economic development of the country, and therefore the preservation of financial stability remains a priority.

Banks account for the largest share of the financial system and are of greatest importance for maintaining the stability of the overall financial system, as well as the stability of other institutional segments, which hold a significant part of their assets in the form of deposits placed with banks.

Pension funds, as financial intermediaries and institutional investors, are significant for maintaining long-term financial stability due to the pension savings of the household sector entrusted to them.

In terms of asset size, the insurance sector represents the third segment of the financial system of the Republic of North Macedonia, with substantial potential for further development in both insurance categories – life and non-life insurance.

The importance of savings houses for the Macedonian financial system is limited, primarily due to the relatively small scale of their activities. Nevertheless, savings houses have their relevance for financial inclusion, as they serve a stable (although small) segment of the credit market that has easier access to financing sources from savings houses than from banks.

After a period of five consecutive years of declining activity, the leasing sector has revived over the past two years, achieving double-digit growth rates in activity. The limited significance of leasing companies for overall financial stability is also observable through their weak interconnectedness with other segments of the financial system.

Despite the notable growth of the activities of financial companies, their importance for overall financial stability remains limited, both in terms of the scale of their operations and their interconnectedness with other parts of the financial system. Given the nature of their activities, financial companies are expected to serve as a complementary mechanism to the lending activity of banks and savings houses, particularly for clients who have restricted access to bank loans due to the banks’ more conservative credit policies.

IMF Report: Preserving financial stability remains a priority; the banking system is stable

The International Monetary Fund (IMF) published its Report for our country, prepared in the context of the decision to approve financial support through the Rapid Financing Instrument. The Report notes that prior to the outbreak of the COVID-19 pandemic, the fundamentals of the Macedonian economy were assessed as sound. According to the IMF, this is evident through solid and diversified economic growth, a sustainable external position, and a well-capitalized and liquid banking system with a low share of non-performing loans in the total credit portfolio. The Report further focuses on the expected effects of the current non-economic shock, noting that the measures and actions undertaken so far to support the economy are assessed as appropriate. (More)

The banking sector is one of the strongest-performing sectors in the country – can it meet the challenges of the crisis?

The functioning of the banking system is exceptionally important because it must influence liquidity, extend credit, and support the private sector both during the crisis and in the future.

According to the most recent data from the National Bank, the banking system remains healthy and stable and has the capacity to withstand the shocks triggered by the coronavirus situation. (More)

REGULATION:

INITIATIVES:

04/12/2025

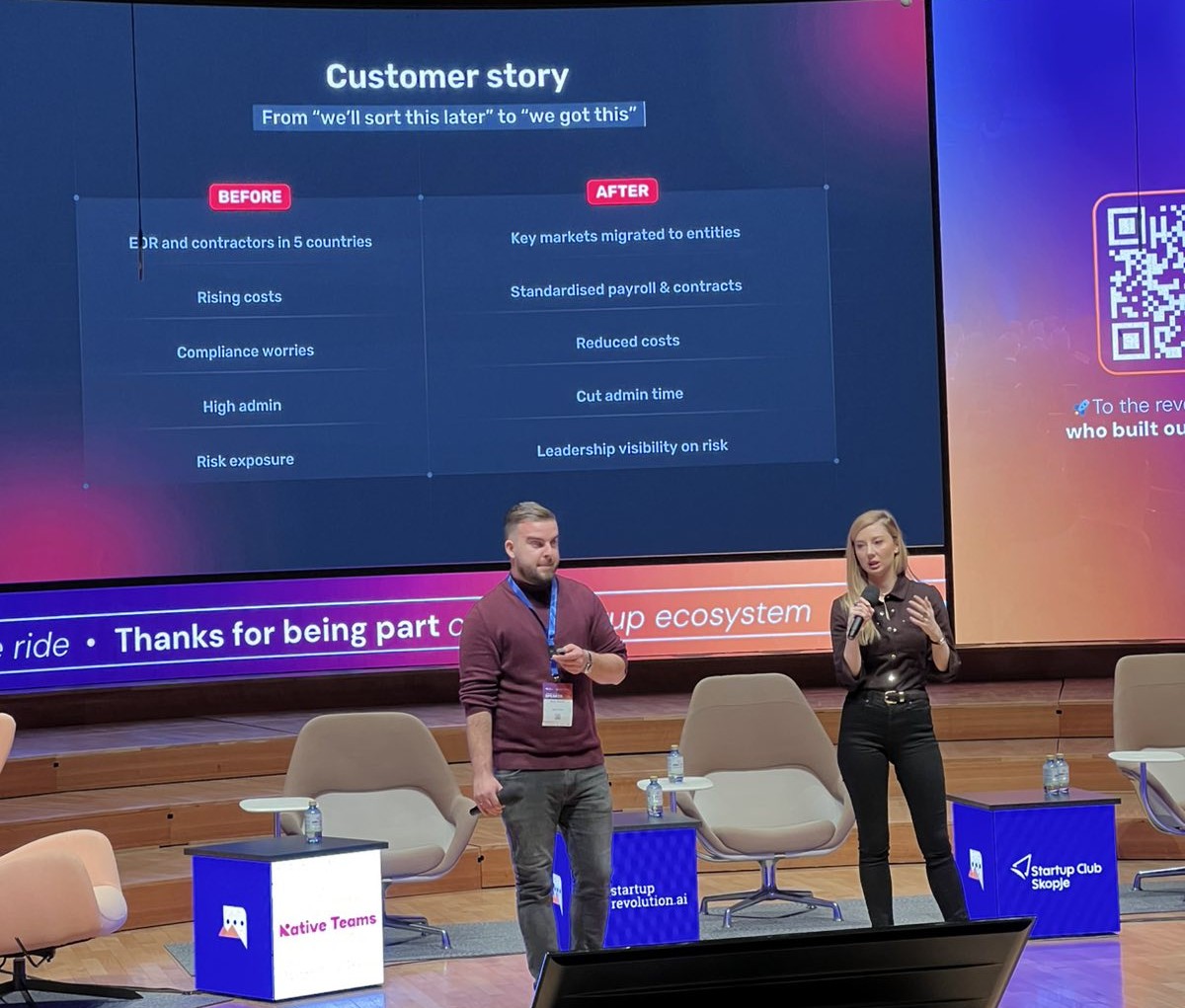

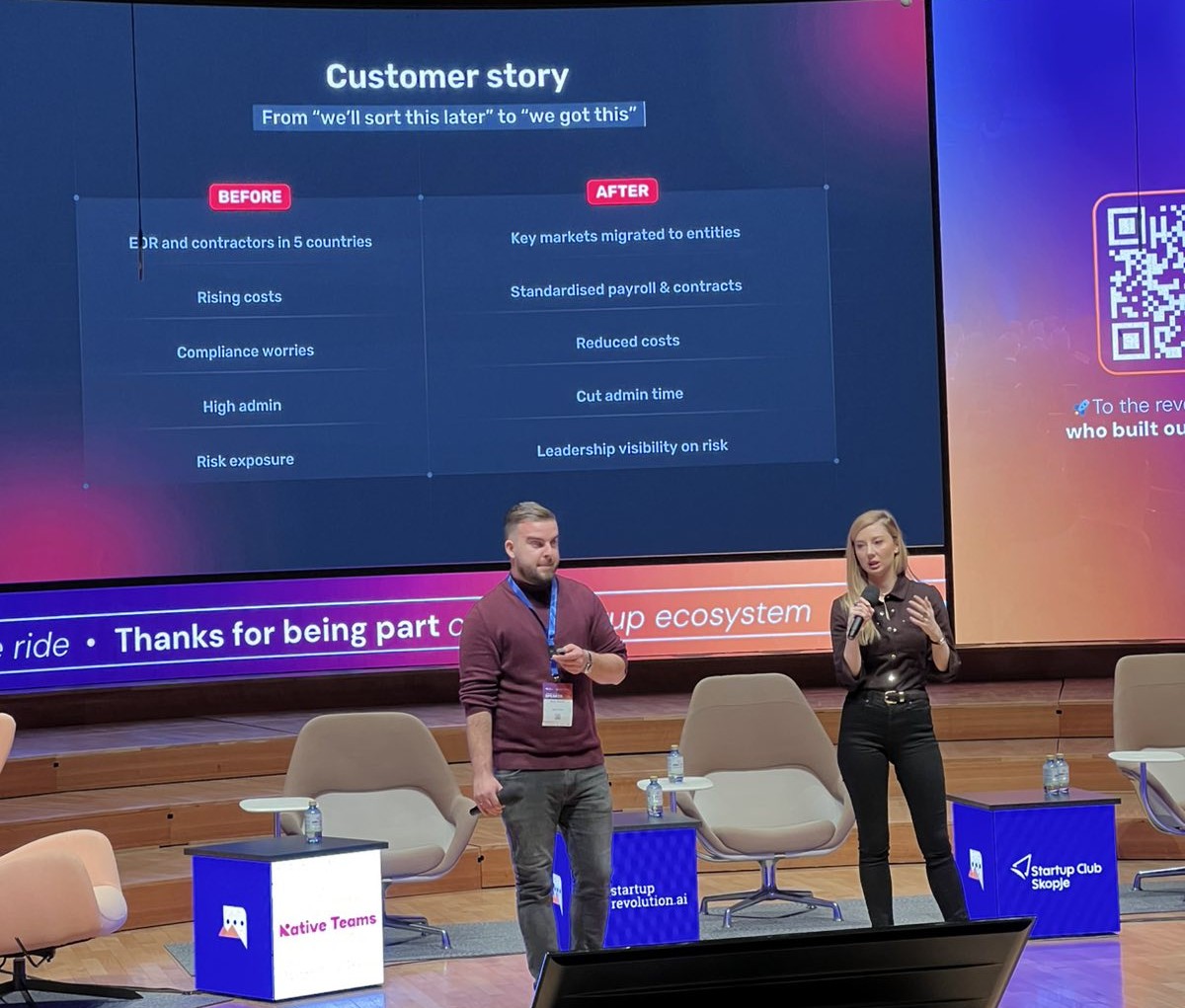

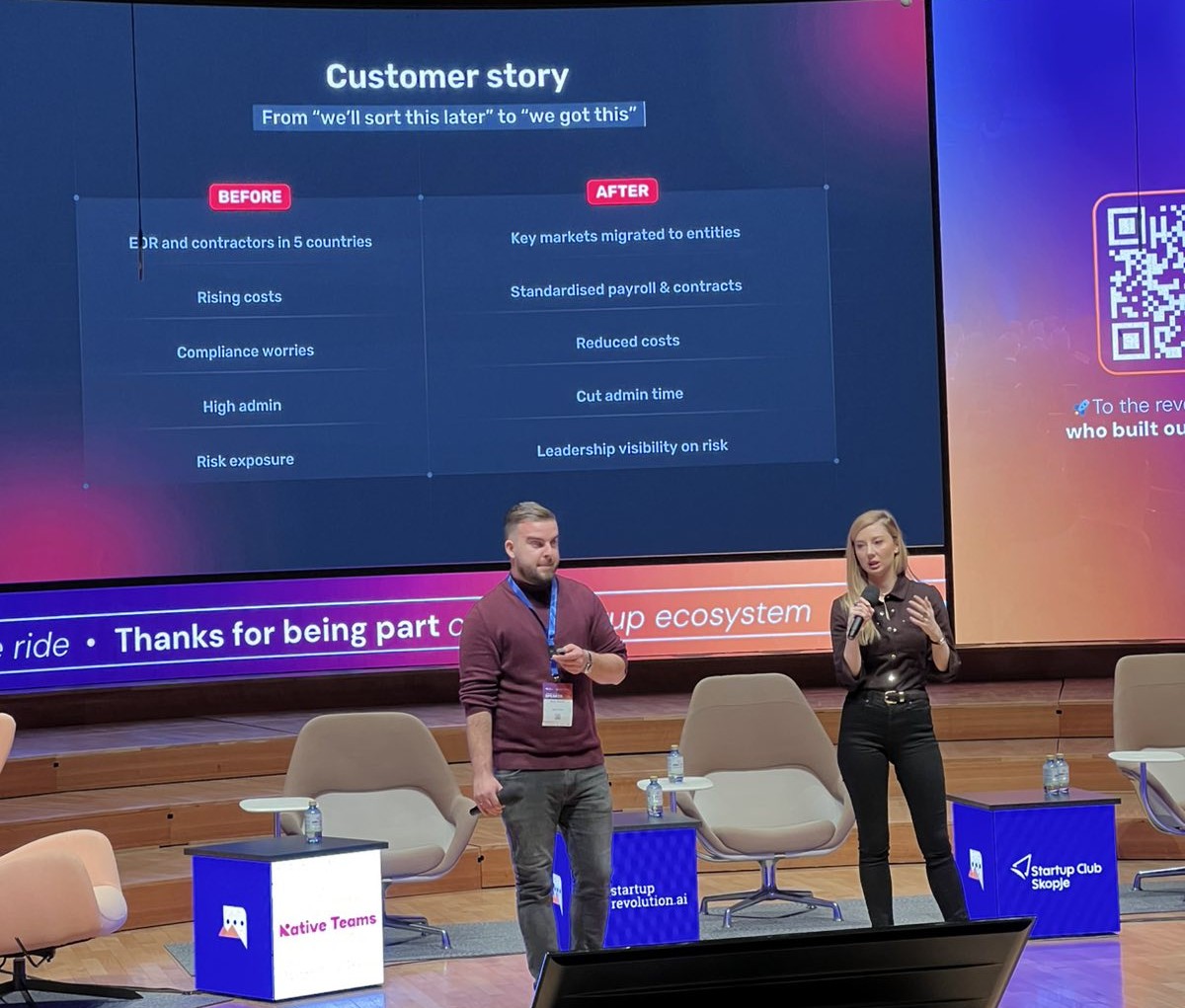

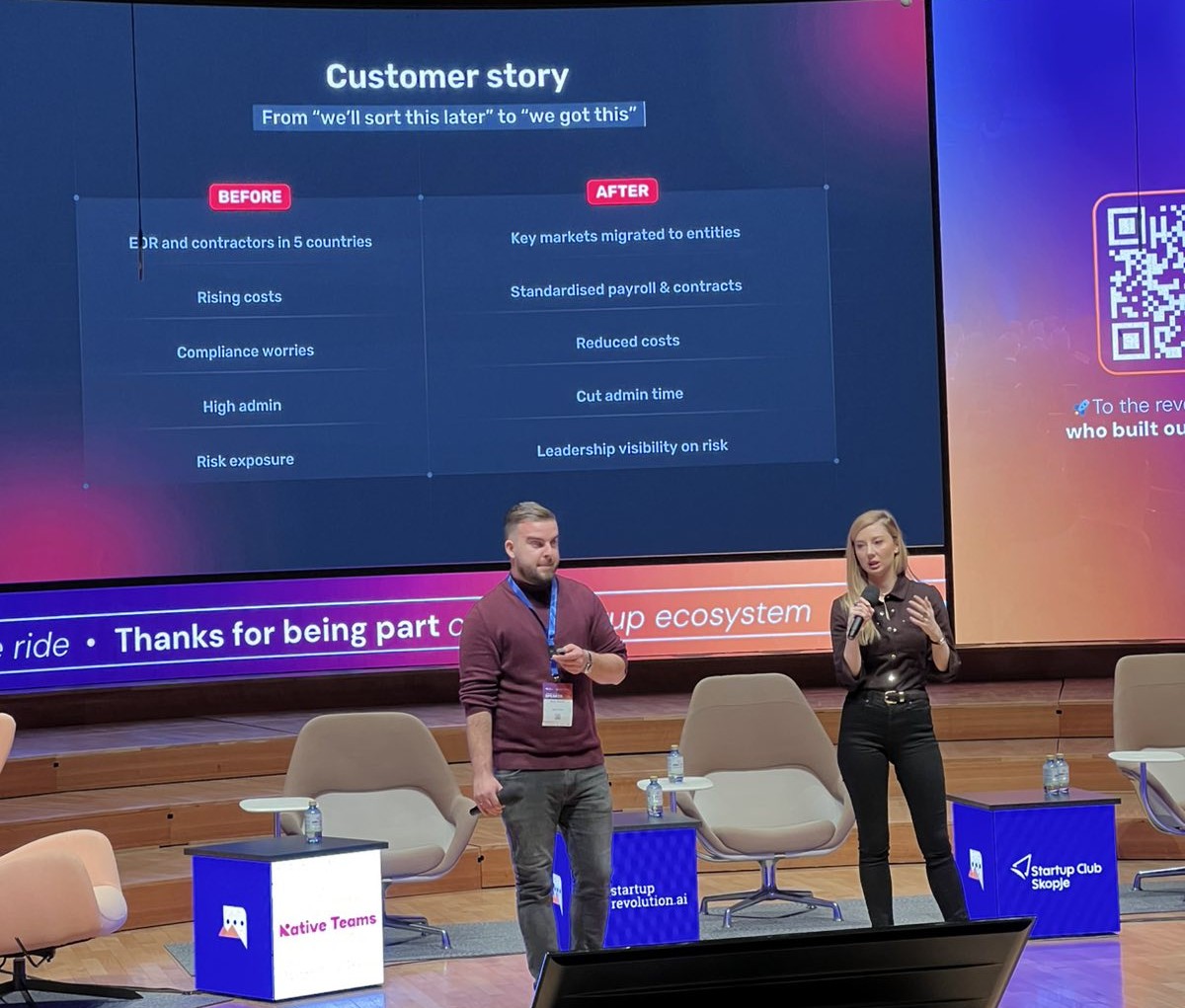

Last week in Skopje, the Startup Revolution AI summit was held—one of the most significant events in the region d...

02/12/2025

In an interview for the program Topic of the Day on MTV, Björn Gabriel, representative of the European Investment ...

27/11/2025

Under the motto ;What if you can do everything,” NLB Banka Skopje marked an important jubilee – 40 years si...

04/12/2025

Last week in Skopje, the Startup Revolution AI summit was held—one of the most significant events in the region d...

02/12/2025

In an interview for the program Topic of the Day on MTV, Björn Gabriel, representative of the European Investment ...

27/11/2025

Under the motto ;What if you can do everything,” NLB Banka Skopje marked an important jubilee – 40 years si...

04/12/2025

Last week in Skopje, the Startup Revolution AI summit was held—one of the most significant events in the region d...

02/12/2025

In an interview for the program Topic of the Day on MTV, Björn Gabriel, representative of the European Investment ...

27/11/2025

Under the motto ;What if you can do everything,” NLB Banka Skopje marked an important jubilee – 40 years si...

04/12/2025

Last week in Skopje, the Startup Revolution AI summit was held—one of the most significant events in the region d...

02/12/2025

In an interview for the program Topic of the Day on MTV, Björn Gabriel, representative of the European Investment ...

27/11/2025

Under the motto ;What if you can do everything,” NLB Banka Skopje marked an important jubilee – 40 years si...